|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

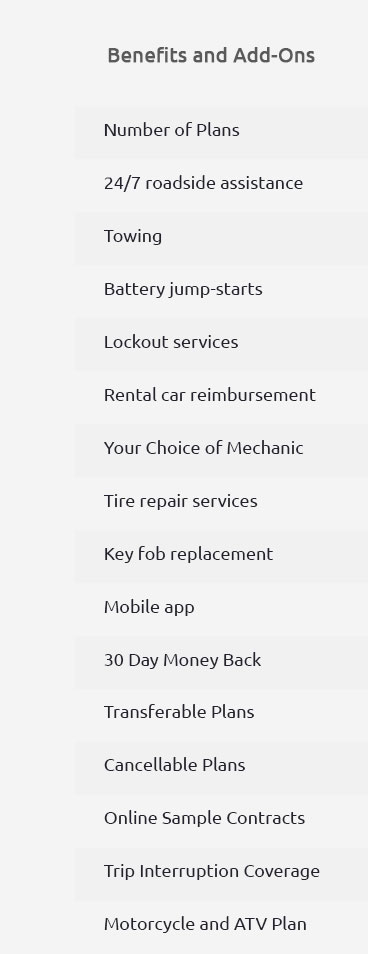

Auto Coverage Rates: A Comprehensive Coverage GuideExploring auto coverage rates can be a daunting task for U.S. consumers. Whether you're worried about vehicle protection, the potential costs of repairs, or considering an extended auto warranty, understanding your options can offer peace of mind and significant cost savings. This guide breaks down what you need to know. Understanding Auto CoverageAuto coverage typically includes a variety of protections for your vehicle. From collision and comprehensive coverage to liability and personal injury protection, knowing what's covered can help you make informed decisions. What's Usually Covered?

Exploring Extended Auto WarrantiesExtended auto warranties offer an additional layer of protection once your manufacturer's warranty expires. They can be particularly beneficial if you own a luxury vehicle such as a BMW. For more details, you can explore bmw extended auto warranty companies. Consider the benefits: Extended warranties can provide peace of mind, protecting you from unexpected repair costs. What to Look For

Calculating Auto Coverage RatesAuto coverage rates vary based on several factors such as your location, vehicle type, and driving history. For instance, in cities like Los Angeles, rates might differ significantly compared to smaller towns. Understanding your chrysler auto warranty rates can provide insight into potential costs and savings. Factors Influencing Rates

FAQs About Auto Coverage RatesWhat is the best way to lower my auto coverage rates?Improving your credit score, maintaining a clean driving record, and bundling policies can help lower your rates. Is an extended auto warranty worth it?For many, an extended auto warranty provides peace of mind and protects against expensive repair costs, especially for luxury vehicles. How do I choose the right coverage?Consider your vehicle's age, value, and your personal financial situation to determine the best coverage for your needs. https://www.geico.com/coverage-calculator/

Comprehensive ? Pays for damage to your car from theft, vandalism, flood, fire or other covered perils. Lower CostN/A, Best Fit$250 (suggested deductible) ... https://www.progressive.com/answers/average-car-insurance-cost/

The average cost of car insurance ranges from $79.83 to $157.27 per month for a liability-only policy from Progressive. https://www.bankrate.com/insurance/car/average-cost-of-car-insurance/

Full coverage car insurance costs an average of $2,670 per year, while minimum coverage is $773 per year. On a monthly basis, full coverage averages $223, with ...

|